Make France Great Again - February 2025

Each month (first week of the month), let's highlight the French startup ecosystem.

Introduction

This article is your February roundup of everything happening in the French startup ecosystem—from key highlights to fundraising news, and everything in between.

I’ll start with France and then try to cover Europe and other interesting ecosystems. The next one are: Belgium, Italy, The Netherlands etc. Let’s Make Europe Great Again.

I’ll do my best to cover it all, and for that I’ll use those sources:

Avolta, Ecap, Déjalevé: French startups fundraising.

Les Echos, Maddyness, French Tech Updates, Frenchweb, Journal du Net, The French Tech Journal 🆕, Dealflow France 🆕: French news.

Techcrunch, EU-Startups, Tech.eu, Sifted, SiliconCanals: European/Worldwide news

Crunchbase, La French Tech Ecosystem 🆕 : Data.

LinkedIn (Startup’s pages, Théo Fleishmaher Rey, Karmen etc.): News.

If you’ve any recommendations, I’ll be happy to update the list above.

Let’s dive in! 👇

Highlights of the month 🔥

The AI Summit 🎙️

The Artificial Intelligence Action Summit, held from February 6 to 11, 2025, in Paris, brought together global leaders, tech industry executives, and scientists to discuss AI's impact on international security, economics, and governance.

Key Highlights:

High-Profile Participation: The summit was co-chaired by French President Emmanuel Macron and Indian Prime Minister Narendra Modi. Notable attendees included OpenAI CEO Sam Altman, U.S. Vice President JD Vance, and representatives from the French tech community.

Major Investments Announced:

The European Union unveiled the "EU AI Champions Initiative," a public-private partnership aiming to mobilize €200 billion for AI development, with the European Commission contributing €50 billion.

In France, President Macron announced €109 billion in private investments for AI, including significant funding for data centers and infrastructure projects.

Divergent Approaches to AI Governance: The U.S. and the U.K. declined to sign a declaration promoting inclusive and sustainable AI, citing concerns over regulatory approaches. This highlighted differing international perspectives on AI regulation.

Industry and Government Collaboration: The summit emphasized the importance of collaboration between governments and tech companies to ensure the development of trusted, safe, and secure AI technologies.

France Announces €109 Billion AI Investment to Compete Globally 🤑

In a bold move to position France as a global leader in artificial intelligence (AI), President Emmanuel Macron has announced €109 billion in AI investments over the coming years. This initiative is meant to challenge the dominance of the United States and China while securing Europe's place in the AI race.

The announcement, made ahead of the AI Summit in Paris, is being compared to Donald Trump’s $500 billion "Stargate" AI initiative in the U.S. Macron stressed the urgency for Europe to act:

"We need to be in this race. We want to innovate, or else we’ll be dependent on others."

Where is the money coming from?

The massive investment package is largely driven by private sector contributions, with key players from around the world committing billions to bolster AI infrastructure, including data centers, cloud computing, and supercomputers.

Key Investments in France's AI Future:

🇦🇪 United Arab Emirates (MGX Fund) → €50 billion to build a 1-gigawatt AI campus, the largest in Europe.

🇨🇦 Brookfield Asset Management → €20 billion by 2030, including €15 billion for data centers and €5 billion for semiconductor and energy projects.

🇬🇧 Fluidstack → €10 billion for the world's largest AI supercomputer, to be deployed in France.

🇺🇸 Amazon → €6 billion to expand its cloud computing infrastructure.

🇺🇸 Apollo Global Management → €5 billion focusing on AI-driven energy projects.

🇺🇸 Digital Realty → €5 billion for 13 new data centers in Marseille and the Paris region.

🇸🇪 Evroc → €4 billion to establish an AI production facility in Mougins.

🇺🇸 Prologis → €3.5 billion for a 400 MW AI energy hub in Île-de-France.

🇫🇷 Iliad → Increasing its investment to over €3 billion to expand AI infrastructure.

🇫🇷 Mistral AI → Investing several billion euros to launch Europe’s largest AI cluster in Essonne.

Beyond Investments: AI Training & Regulation

Macron’s plan isn’t just about money—it’s about making France an AI powerhouse. The government has announced:

AI workforce expansion → 100,000 young professionals trained annually (up from 40,000 today).

35 pre-approved locations for new AI data centers.

AI regulation & ethics framework → Macron pledged to introduce "strong principles on AI ethics, copyright, and misinformation."

Industry partnerships → Companies like Mistral AI, Stellantis, Owkin, and Wandercraft are working closely with the government to drive AI adoption.

"Plug, Baby, Plug"—Macron's Call to Action

In a memorable moment during the summit, Macron coined the phrase "Plug, baby, plug"—a play on Trump’s "Drill, baby, drill"—to promote France’s nuclear-powered AI revolution. The message? France has the clean energy needed to fuel the future of AI.

Europe's AI Fight: A Wake-Up Call

Macron’s announcement comes as Europe struggles to compete with AI giants in the U.S. and China. His “Notre-Dame Strategy” calls for fast-tracking AI investments just like the rapid rebuilding of Notre-Dame Cathedral after its fire.

Meanwhile, the U.S. and the U.K. refused to sign a global AI agreement promoting "inclusive and sustainable AI," showing stark divisions in the international approach to AI governance.

Final Takeaway

With €109 billion on the table, France is making its move in the AI race. The question is: Will it be enough to secure Europe's place alongside AI superpowers?

Bpifrance → €10b for AI 📈

Bpifrance has announced a €10 billion investment plan to enhance the nation's artificial intelligence (AI) ecosystem by 2029. This initiative aims to strengthen innovation, establish a sovereign technological sector, and support the adoption of AI across French enterprises. The investment plan encompasses the entire AI value chain, focusing on:

Direct Equity Investments, Support for High-Growth Companies, Fund-of-Funds Approach.

Since 2015, Bpifrance has invested over €1 billion directly into AI enterprises, including prominent companies like Mistral AI, H, and Chapsvision. In 2024 alone, €3.4 billion was allocated to AI projects through the France 2030 initiative, covering areas such as embedded AI, generative AI, and cloud technologies.

Nicolas Dufourcq, CEO of Bpifrance, emphasized that France possesses the talent and ecosystem necessary to become a leader in AI. He stated that these investments are designed to reinforce this dynamic and position France as a global player in the sector.

French Tech faces €3b budget cut 🚨

The 2025 French budget delivers a €3 billion blow to the startup ecosystem, impacting France 2030, tax incentives, and innovation funding.

The Big Cuts: What’s Changing?

📉 France 2030 Slashed → €2 billion delayed, stretching the program over more years, limiting immediate funding for deeptech and industrial innovation.

📉 Crédit d’Impôt Recherche (CIR) Hit → Patent-related expenses and tech monitoring removed, and PhD hiring incentives scrapped. Deeptech and biotech startups—already operating on long R&D cycles—will struggle.

📉 Crédit d’Impôt Innovation (CII) Cut → Drops from 30% to 20%, reducing the number of eligible startups by half.

📉 Young Innovative Company (JEI) Program Tightened → R&D spending threshold raised from 15% to 20%, making it harder for startups to qualify.

Why This Matters

🚀 Deeptech & AI Startups Are the Most Exposed → With long development cycles and no immediate revenues, biotech, AI, and quantum startups rely heavily on these tax incentives. Cutting them could slow breakthroughs.

💼 Hiring Gets Harder → The removal of incentives for hiring young PhDs means fewer high-skill R&D roles. Some startups may delay hiring, while others will struggle to attract talent.

🏢 Fewer Startups Qualify for Support → Stricter JEI conditions mean fewer startups will receive exemptions, potentially discouraging new ventures.

Some Good News?

✅ Investment Tax Breaks for Individuals → A new 30% tax reduction for indirect investments in JEI startups (through funds or clubs) could attract more private investors.

✅ More Support for Diversity & Inclusion → French Tech Tremplin (+€1M) for underprivileged founders and Tech Pour Toutes (+€1M) for women in tech receive extra funding.

France has spent years (trying) positioning itself as a leader in AI, deeptech, and innovation, but these cuts send the wrong signal. While some incentives remain, reducing support for early-stage and deeptech startups could slow the very innovation France wants to lead.

Money is flowing? 💰

Fundraising, fundraising, fundraising. After a quiet end to the year, let's get back to investing. What happened this month?

IPO: 0.

Series B/C/D: 12 with +€199.20m raised (73 Strings, Adocia, CCE Group, Dametis, EG 427, Germitec, INOE, NETRI, Riot, ThePackengers, Stockly)

Series A: 19 with +€120.5m raised (Oncodiag, BiOceanOr, The QA Company, NEO ECO, Wavo, Activ'Inside, Histovery, Revolte, Extracthive, Cycloid, Circle Safe, ABIONYX Pharma, Smile Wanted, Cryptio, ScorePlay, SuperBranche, Spore.Bio, PulseSight Therapeutics, Papkot.)

Seed: 27 with +€66.8m raised (Allaw, Pronoe, Genial, Upciti, FullEnrich, AITHRA, Aleph-Networks, AlterDiag, Anybuddy, Crown Procurement, MB-Therapeutics, SeaWeed Concept, Toasty, MoEa, Ekstere, Lyv Healthcare, Novacium SAS, Epyr, Mantle8, Neuralk AI, Mangas.io, Sirius NeoSight, ERS, Reev, Wallace Technologies, VirtualiSurg, Akira Technologies.)

Pre-seed: 14 with +€19.99m raised (Byzantine Finance, Edumapper, Plantibodies, Terroe, Symexo, Agri Lab Leverage, ToumAI, Fraktion, Speeral, Vegetal Food, Akidaia, CountAct, Melia, Ochy.)

Others:

1 spinout (VCAST) → 0€

Top Sectors: Sustainability (11 startups), BioTech (9 startups), SaaS & Healthcare (7 startups), AI (5 startups)

Total raised: €415.59m

Highlights

Edumapper is transforming how students choose their higher education paths, ensuring that no decision feels like a leap into the unknown. Too many students lack access to reliable, comprehensive insights about available programs, real career opportunities, and admission probabilities. By offering a free, all-encompassing platform covering everything from post-bac to master’s degrees, including international programs, Edumapper is breaking barriers in education. Backed by daphni, Eurazeo (HEC Ventures), Ring Capital, and Kima Ventures, it secured €5M in a Pre-seed round.

Epyr is leading the charge in industrial decarbonization with its innovative thermal energy storage solutions. By enabling efficient renewable energy storage, Epyr helps industries transition toward sustainable practices. Recently, it raised €3M in a Seed round with support from Daphni, AENU, OVNI Capital, and WEPA Ventures.

FullEnrich is revolutionizing global data enrichment by enhancing companies' ability to leverage actionable insights. With a €1.9M Seed round led by Flex Capital, Kima Ventures, and First Degree, FullEnrich is accelerating its growth in the SaaS market and will seek to become the #1 enrichment platform.

Neuralk AI is building specialized AI foundation models tailored for business applications. By integrating AI into enterprise operations, Neuralk AI is making complex problem-solving more efficient. Securing €3.8M in a Seed round, backed by Fly Ventures, Station F, and a network of angel investors.

Spore.Bio is advancing on-site microbiology testing by providing rapid and automated contamination detection solutions. Its breakthrough technology enhances safety in healthcare, food, and pharma industries. With a €23M Series A round, backed by Singular, LocalGlobe, Station F, and others, Spore.Bio is reshaping the future of microbiology.

73 Strings is an AI-powered financial advisory platform optimizing valuation and risk management for private markets. Its advanced analytics enable firms to make faster, data-driven investment decisions. With a €52.6M Series B round, supported by Blackstone, Goldman Sachs, and Hamilton Lane, 73 Strings is revolutionizing financial intelligence.

Germitec is eliminating hospital-acquired infections with its chemical-free, ultra-fast disinfection solutions for ultrasound probes. By automating high-level disinfection, Germitec enhances patient safety and reduces contamination risks. It secured a €29M Series B round, backed by Turenne Capital, Eurazeo, and Kurma Partners;

Riot is strengthening corporate cybersecurity by equipping employees with the tools to defend against cyber threats. Through real-time protection and AI-driven security protocols, Riot ensures organizations stay resilient against attacks. A €28.9M Series B round, led by Left Lane Capital, Y Combinator, and Base10, is fueling its mission to redefine cybersecurity.

Stockly is the Global Inventory for Retail, helping brands optimize stock availability by seamlessly managing excess inventory across multiple retailers. With a €26M Series C round, backed by Eurazeo, 83North, and Daphni, Stockly is transforming SaaS-powered inventory management.

Weward is revolutionizing how we perceive walking by turning steps into cash! This mobile application rewards users for their physical activity, encouraging healthier lifestyles while integrating gamification and financial incentives. Founded by Yves Benchimol, Tanguy de La Villegeorges, and Nicolas Hardy, Weward has caught the attention of major investors and celebrities. This month, it secured funding in an Angel round backed by Venus Williams, showcasing growing interest in HealthTech solutions that promote well-being.

The list

ABIONYX Pharma is advancing sepsis treatment with recombinant apoA-I therapy. Backed by the France 2030 i-Démo program, it raised €8.7M in a Series A round to accelerate development in HealthTech. ABIONYX Pharma

Activ'Inside develops ingredients for the food supplement industry. It secured €4M in a Series A round from Aquiti via the NACI 1 fund, Bpifrance, and its executive team to scale operations in FoodTech. Activ'Inside

Adocia is a biotechnology company innovating treatments for diabetes and metabolic diseases. It raised €9.7M in a Series B round, backed by Armistice Capital, Vester Finance, and other investors. Adocia

Agri Lab Leverage promotes the use of plant-based waste and co-products for sustainable agriculture. It secured €900K in a Pre-seed round with support from Femmes Business Angels, SideAngels, and TimeToAct Capital. Agri Lab Leverage

AITHRA simplifies the production of technical ceramics for the space industry. It raised €2M in a Seed round with funding from Bpifrance, ESA, CNES, and France Angels networks. AITHRA

Akidaia offers a non-connected access control solution for sensitive sites. It raised €1.3M in a Pre-seed round with backing from Bpifrance, Bouygues Construction, Leonard Invest, and several angel investors. Akidaia

Akira Technologies specializes in designing and executing engineering projects. It secured funding in a Seed round with investments from Bpifrance, MBDA, and Definvest to support innovation in EnerTech. Akira Technologies

Aleph-Networks develops OSINT data processing tools to detect data leaks and security threats across all web layers. It raised €2M in a Seed round led by AG2R La Mondiale and Accurafy4. Aleph-Networks

Allaw is a legaltech platform connecting individuals with legal professionals while streamlining legal processes. It secured €1.5M in a Seed round backed by Sowefund, Delambre, and Fastea. Allaw

AlterDiag develops rapid diagnostic tests using single-domain antibodies for medical applications. It raised €2M in a Seed round with support from Forepont. AlterDiag

Anybuddy is making racket sports more accessible with a reservation app for court bookings. It raised €2M in a Seed round led by Seventure Partners, Benjamin Kayser, and other investors. Anybuddy

BiOceanOr is pioneering underwater weather stations for real-time and predictive water quality monitoring. It secured €2M in a Series A round from GO Capital, Caisse d'Epargne, and The Yield Lab Europe. BiOceanOr

Byzantine Finance is redefining the crypto space with its infrastructure solutions. It raised €2.8M in a Pre-seed round led by Node Capital and Blockwall, alongside prominent industry investors. Byzantine Finance

CCE Group provides aerospace solutions specializing in cabin and cargo equipment for niche markets. It raised an undisclosed amount in a Series B round backed by HIG Capital. CCE Group

Circle Safe is developing a next-generation catheter that significantly reduces post-operative complications in atrial fibrillation procedures. It raised €8M in a Series A round from Odyssée Venture, Bpifrance, and angel investors. Circle Safe

CountAct offers a crisis management solution for businesses, helping organizations respond effectively to emergencies. It secured €1.3M in a Pre-seed round led by Grenoble Angels, 50 Partners, and Business Angels. CountAct

Crown Procurement optimizes procurement processes with a platform enabling fair and transparent e-auctions. It raised €2M in a Seed round with funding from Kima Ventures, Bpifrance, and other investors. Crown Procurement

Cryptio provides financial management tools for crypto assets, helping businesses maintain compliance and optimize accounting. It raised €11M in a Series A round backed by leading crypto investors. Cryptio

Cycloid is enhancing sustainable platform engineering with tools for efficient software deployment. It secured €5M in a Series A round from Reflexion Capital and French angel investors. Cycloid

Dametis helps industrial sites improve ecological performance through smart resource management. It raised €7M in a Series B round from Eiffel Investment Group and the Île-de-France Décarbonation fund. Dametis

Dowgo simplifies ESG and extra-financial data reporting for investors, ensuring compliance with SFDR requirements. It is supported by 50 Partners Web3 in an Accelerator program. Dowgo

EG 427 is pioneering pinpoint gene therapy, focusing on targeted neurological applications. It raised €27M in a Series B round, backed by Bpifrance and Andera Partners, to advance its Biotech solutions. EG 427

Ekstere is revolutionizing sustainable mobility with its platform for reconditioned electric bike sales. It secured €2.4M in a Seed round from Seventure Partners and Business Angels. Ekstere

Enersens develops best-in-class thermal barriers for batteries and aerospace applications. Backed by the European Innovation Council, it secured €1M in a Grant/Convertible round. Enersens

ERS is setting a new carbon standard to measure impacts on climate and biodiversity. It raised €5M in a Seed round, backed by LocalGlobe, noa, and AENU, to drive sustainability innovation. ERS

Extracthive streamlines VAT management across the European Union. It secured €4.6M in a Series A round with support from CEA Investissement and Citizen Capital to expand its SaaS solution. Extracthive

Fraktion enables the launch and management of investment platforms with ease. It raised €1.1M in a Pre-seed round backed by VOX CAPITAL, Tezos Foundation, and Cabrit Capital. Fraktion

Genial builds AI-powered agents to help SMEs automate workflows and enhance efficiency. It raised €1.8M in a Seed round from Huttopia, Crédit Agricole, and Founders Futures. Genial

Histovery enhances cultural heritage with augmented reality experiences for museums and historical sites. It secured €4M in a Series A round from Bpifrance and MI3 to scale its CultureTech solutions. Histovery

Iktos advances AI and robotics-driven drug discovery. Backed by the EIC Accelerator, it secured €2.5M in a Grant round to accelerate its AI-powered Biotech research. Iktos

INOE is driving sustainable wood energy development. It secured Series B funding from Meanings Capital Partners to expand its impact in Sustainability. INOE

Lyv Healthcare is revolutionizing endometriosis management with its digital healthcare platform. It raised €2.6M in a Seed round backed by FNMF, Investir&+, INCO Ventures, and others. Lyv Healthcare

Mabqi is developing a patented antibody targeting metastatic prostate cancer. It secured €5M in a Grant round from Bpifrance under France 2030 to advance its Biotech innovations. Mabqi

Mangas.io is redefining manga consumption as the "Netflix of manga." It raised €4M in a Seed round from QVEMA and Crowdfunding to expand its CultureTech platform. Mangas.io

Mantle8 specializes in natural hydrogen exploration using advanced geoscience technologies. It secured €3.4M in a Seed round from Kiko Ventures, Breakthrough Energy Ventures Europe, and Business Angels, including Bill Gates. Mantle8

MB-Therapeutics is transforming healthcare with 3D-printed medicines. It raised €2M in a Seed round backed by Beprep, Calyseed, Angels Santé, and Bpifrance. MB-Therapeutics

Melia is accelerating renewable energy adoption with its innovative solutions. It secured €1.3M in a Pre-seed round from Renewable Energy Backers. Melia

Minah is facilitating investment in sub-Saharan real estate and land using blockchain and deep local expertise. It is part of 50 Partners Web3’s Accelerator program. Minah

MoEa is redefining sustainable fashion with innovative vegan sneakers. It secured €2.3M in a Seed round from Go Capital, Ring Capital, Climate Club, and others. MoEa

Naali produces high-quality natural food supplements based on saffron, promoting a healthier lifestyle. It raised €600K in an Angel round backed by Jean-Michel Aulas, Jean-Michel Karam, and Kelly Massol. Naali

NEO ECO develops MonPortailRH, the first collaborative HR platform for SMEs. It secured €3M in a Series A round backed by Odyssée Venture and Business Angels Europe. NEO ECO

NETRI scales the production of organ-on-chip technology for biomedical research. It raised €5M in a Series B round from Private Investors to expand its Biotech solutions. NETRI

Novacium SAS is developing new materials and processes for the renewables sector. It secured €2.6M in a Seed round to push forward its sustainability innovations. Novacium SAS

Ochy provides a smartphone app offering real-time running form and gait analysis. It raised €1.7M in a Pre-seed round from Redstone’s Social Impact Fund, Look AI Ventures, Bpifrance, Berkeley SkyDeck, and Agile Physical Therapy. Ochy

Oncodiag is developing diagnostic and monitoring tests for various cancers. It secured €1.4M in a Series A round from Business Angels to enhance early cancer detection. Oncodiag

Papkot offers advanced plastic-free coating technology, enabling high-performance, fully recyclable solutions. It raised an undisclosed Series A round backed by the Fedrigoni group. Papkot

Plantibodies is building a sustainable biotech platform for oral biologics. It raised €190K in a Pre-seed round from BADGE to advance its Biotech research. Plantibodies

Pronoe develops solutions for carbon removal and pollutant reduction in water. It secured €1.5M in a Seed round from CarbonFix to advance sustainability efforts. Pronoe

PulseSight Therapeutics is developing disruptive non-viral gene therapies for major eye diseases. It raised an undisclosed Series A round from Korea Investment Partners, Pureos Bioventures, and +ND Capital. PulseSight Therapeutics

Reev is developing a robotic orthosis device to reduce muscle fatigue and enhance mobility for individuals with impairments. It raised €8.8M in a Seed round from Polytechnique Ventures, Newfund, Irdi Capital, Techstars, and Business Angels. Reev

Revolte is innovating mobility and insurance solutions with e-garages. It secured €4M in a Series A round backed by MACIF, Groupe IMA, Bpifrance, and Business Angels. Revolte

ScorePlay is an AI-powered platform transforming sports media management by automating content tagging, organization, and distribution. It raised €12.5M in a Series A round from 20VC, Seven Seven Six, APEX Capital, and others. ScorePlay

SeaWeed Concept is scaling the production of lacto-fermented seaweed for human consumption. It secured €2M in a Seed round from Blue Forward Fund and Seventure Partners. SeaWeed Concept

Sirius NeoSight advances oncology-focused predictive therapy via blood-based tests. It raised €4.4M in a Seed round from Demeter Partners, Octalfa, GO Capital, Angels Santé, Evolem, and others. Sirius NeoSight

Smile Wanted is expanding a digital advertising marketplace using a cookieless, AI-driven algorithm. It raised €10M in a Series A round backed by Elevation Capital Partners and Bpifrance. Smile Wanted

Speeral is a marketplace connecting businesses with second-hand product sites, promoting a circular economy. It raised €1.2M in a Pre-seed round from Aquiti, Emmanuel Grenier, Philippe Brochard, and others. Speeral

SuperBranche is a medtech company designing nanoparticles for cancer diagnosis and treatment. It secured €13M in a Series A round from Bpifrance, Capital Grand Est, and Family Offices. SuperBranche

Symexo provides enterprise infrastructure management software for large-scale digital operations. It raised €750K in a Pre-seed round from Multicroissance and Bpifrance. Symexo

Terroe is developing a new model of local industry by deploying ultra-local vegetable processing units. It raised €250K in a Pre-seed round from Business Angels. Terroe

The QA Company develops QAnswer, an AI tool that turns complex data into clear answers. It secured €2.8M in a Series A round from Bpifrance, UI Investissement, and other local investors. The QA Company

ThePackengers is a logistics startup specializing in fragile art and luxury item transport. It raised €14M in a Series B round from Weber Investissement, Reflexion Capital, and Transolution. ThePackengers

Toasty is an e-commerce personalization platform helping brands tailor customer experiences. It raised €2M in a Seed round from Sowefund. Toasty

ToumAI provides local ESG data solutions for Africa, amplifying community voices for sustainability. It secured €1M in a Pre-seed round backed by Bpifrance, Orange Ventures, and Digital Africa. ToumAI

Upciti supplies localized real-time data for smart cities and retailers. It raised €1.8M in a Seed round from Demeter Partners. Upciti

VCAST provides online and multichannel voting solutions. It is a spinout from INRIA and the French National Centre for Scientific Research. VCAST

Vegetal Food specializes in vegan snacks and fresh products that are sugar-free, gluten-free, and organic. It raised €1.2M in a Pre-seed round from Elevation Capital and Foodxpert. Vegetal Food

VirtualiSurg is a meta-learning platform where surgeons practice techniques in a VR-powered operating room with AI-guided mentorship. It is backed by Medtronic, J&J Medtech, and Dräger. VirtualiSurg

Wallace Technologies provides alternative energy storage solutions. It secured Seed funding from BADGE, Saint-Etienne Business Angels, and Bpifrance. Wallace Technologies

Wavo provides debt-free inventory financing for SMEs. It raised €3.5M in a Series A round from Clint Capital, Kima Ventures, HUB612, and Tony Parker. Wavo

Acquisitions 🤑

Highlights

FuturMaster strengthens its leadership in Supply Chain Planning with the acquisition of PlaniSense, integrating advanced scheduling and production planning capabilities into its Bloom platform. Backed by Sagard NewGen, the combined entity now serves top clients such as Heineken, L’Oréal, and LVMH, solidifying its position in global supply chain optimization.

Appier has acquired AdCreative.ai for $38.7M, reinforcing its Generative AI-driven advertising solutions. This acquisition enhances Appier's product portfolio, expands its presence in Europe, and accelerates AI-powered marketing innovation. By combining forces, the two companies aim to optimize ad creative generation and boost campaign efficiency for brands in eCommerce, gaming, and consumer goods.

Bio-Rad acquires Stilla Technologies in a $225M deal (+$50M earnout), marking a major exit in French biotech. Specializing in precision genetic analysis, Stilla has developed next-gen digital PCR solutions for clinical diagnostics and life sciences research. With offices in Boston, Japan, and China, the French company has demonstrated global success, positioning itself as a key player in genetic testing advancements.

The list

AdOpt, a consent management platform, joins Axeptio, enhancing compliance and privacy solutions in the CMP sector. AdOpt

Akerva, a cybersecurity consulting firm, has been acquired by Magellan Sécurité, expanding its cybersecurity expertise. Akerva

Arcastream, specializing in high-speed data processing, is now part of Datacore, reinforcing enterprise software capabilities. Arcastream

Axcias, a digital procurement transformation agency, has been acquired by EPSA, furthering its procurement optimization services. Axcias

Carviz, a mobility solutions provider, is now part of bee2link group, strengthening its automotive technology offerings. Carviz

Crop & Co, offering procurement solutions, has been acquired by Okaveo Group, expanding its strategic sourcing expertise. Crop & Co

Dats'up & Perl, specializing in Big Data services, have joined Jems, reinforcing their data-driven consulting capabilities. Dats'up & Perl

Didactic - Medical Devices, a provider of medical devices, has been acquired by Arion Group, strengthening its MedTech portfolio. Didactic

Dolist, a marketing automation platform, has been acquired by TSS, enhancing its digital marketing solutions. Dolist

Evoliz, a fintech solutions provider, has been acquired by Visma, expanding its financial management services. Evoliz

Farmitoo, an agricultural marketplace, has been acquired by Agriconomie.com, consolidating its position in Agritech. Farmitoo

Feelserv, an IT services provider, has been acquired by Constellation, expanding its IT consulting expertise. Feelserv

Forgerz, a digital product studio, has been acquired by Impactiv, enhancing its IT consulting offerings. Forgerz

Goot, a leader in B2B e-commerce solutions for food and beverage distribution, has been acquired by Choco, strengthening its supply chain capabilities. Goot

IDVerse, an AI-powered identity verification provider, has been acquired by LexisNexis Risk Solutions, enhancing security and fraud prevention. IDVerse

ISE Systems, a data consulting firm, has been acquired by Komposite, strengthening its IT consulting portfolio. ISE Systems

Jetpulp, a digital marketing agency, has been acquired by Datasolution, expanding its marketing service capabilities. Jetpulp

kpiWeb, a smart BI decision-making platform, has been acquired by NG Audit, reinforcing its SaaS business intelligence tools. kpiWeb

Les Nouveaux Affineurs, a vegan food startup, has been acquired by Jay&Joy, strengthening its presence in the FoodTech sector. Les Nouveaux Affineurs

MobileIT, specializing in traceability and identification software, has been acquired by Solutys, enhancing logistics solutions. MobileIT

NaturaBuy, a leading marketplace for outdoor and hunting gear, has merged with Ultimate Fishing to build a comprehensive platform for nature enthusiasts. NaturaBuy

NEOSYAD, a MedTech solutions provider, has been acquired by MicroAire Surgical Instruments, expanding its medical innovation offerings. NEOSYAD

Noiise, a digital marketing agency, has undergone an LBO with Bpifrance, supporting its growth in marketing services. Noiise

OLY Be, a yoga class app, has been acquired by Trainsweateat, enhancing digital wellness offerings. OLY Be

Prevantis, a workplace risk management software provider, has been acquired by Spartes, strengthening its risk management services. Prevantis

Tarifeo, a digital catalog for the construction industry, has been acquired by Sydev, expanding its PropTech solutions. Tarifeo

Teeps, an AI-driven advertising solutions provider, has been acquired by Adwanted Group, reinforcing its digital advertising capabilities. Teeps

The Ramp, a multilocal advertising solutions provider, has been acquired by Datventure, expanding its marketing reach. The Ramp

Tiempo Secure, a cybersecurity solutions provider, has been acquired by Qualcomm, strengthening its security technology. Tiempo Secure

Ucase Consulting, an IT consulting and data services firm, has been acquired by Humanskills, reinforcing its IT consulting expertise. Ucase Consulting

Videtics, specializing in AI-powered video surveillance, has been acquired by Technis, expanding security and cybersecurity offerings. Videtics

VPWhite, an IT services provider, has been acquired by Magellan Partners, strengthening its digital transformation services. VPWhite

ZIQY, a circular economy subscription management platform, has been acquired by pfsTECH, reinforcing sustainability-focused digital solutions. ZIQY

Bankruptcy 👋

I deleted this part, I don’t like it. You can find it in other news.

New funds (and startup studio) 🎥

ISAI closes €300M Fund

ISAI, one of France’s leading tech-focused investment firms, has finalized the closing of its Expansion III fund, securing €300M, exceeding its original target of €250M. This fund is dedicated to investing in profitable SMEs and mid-sized tech companies through Tech Buyout and Tech Growth strategies. ISAI plans to back 12 to 15 companies, with investments ranging from €10M to €50M in Europe, including France, Southern Europe, Switzerland, and the Benelux region. The fund is backed by a mix of entrepreneurs and institutional investors, including Bpifrance, Flexstone Partners, Swen Capital Partners, Eurazeo, and the European Investment Fund.

The first investment from this fund was made in Staffmatch, a leading digital temporary work platform in France.

Emblem, between France and the Nordics

Emblem, a new venture capital fund co-founded by Bénédicte de Raphélis Soissan (ex-Clustree) and Guillaume Durao (ex-Idinvest/Eurazeo), has closed its first fund at €50M, with a final target of €75M. The fund will focus on early-stage startups in France, Denmark, and Sweden, investing between €500K and €3M per company. Emblem aims to support around 30 startups, leveraging the founders’ expertise in the Nordic and French ecosystems.

The fund’s LPs include a mix of French and Nordic investors, such as the Danish sovereign fund, family offices, and prominent tech entrepreneurs (including founders of Qonto, Swile, Spendesk, and Pleo).

Isalt

The European Investment Fund (EIF) has committed €40 million to the Fonds Stratégique des Transitions (FST), managed by ISALT, reinforcing its mission to scale innovative French SMEs and mid-sized companies in alternative energy, decarbonized industry, and technological innovation. With this investment, the final closing of FST is set to reach €300M by March 2025. Since its launch in March 2023, FST has already backed Tissium (medtech), Intact (regenerative ingredients), Unseenlabs (maritime surveillance tech), and Énergies de Loire (solar energy infrastructure), with two more investments in the pipeline. This latest injection from FEI strengthens ISALT’s position in supporting high-impact industrial transitions across France. 🚀

The ‘Rebranding’ trend

Venture capital firms are evolving—not just in strategy, but in identity. Over the past few months, major European funds like Ventech, Breega, and Founders Future have embraced a brand refresh: new phase of growth, specialization, and ambition.

Who’s next?

Roundtable launch

The trend of community-driven investing is gaining momentum, with Roundtable announcing the launch of 15 new public investment communities across Europe. This expansion strengthens its presence in Germany and diversifies its asset focus into real estate 🏡, further democratizing access to private markets.

Among the newest communities are high-profile French investment leaders, including:

Blaise Matuidi & Salomon Aiach (Origins) – Focused on late-stage private companies like OpenAI & SpaceX

Alexandre Berriche – Specializing in scale-up secondaries

Christophe Raynaud, Noé Gersanois, Younes Rharbaoui (OPRTRS)

Baptiste Hamel & Nicolas Douay (Better Angle)

Victor Mertz & Martin Charpentier (Source Venture)

Jonathan Anguelov (Aguesseau Capital - Real Estate)

With Europe’s venture ecosystem evolving, community-led funds are reshaping the landscape—connecting investors with strategic, high-impact opportunities.

Other news? 🫣

LVMH's Startup House 🏛️

LVMH's La Maison des Startups is redefining corporate acceleration by blurring the lines between a startup incubator and an experimental innovation lab. The luxury giant is using the program not just to mentor but also to co-create with selected startups, integrating new tech directly into its ecosystem.

The Builders Factory: A new incubator between 42 and The Family 🏗️

A new kind of entrepreneurial launchpad emerges with The Builders Factory, positioned between École 42’s hacker culture and The Family’s elite startup coaching. The incubator focuses on raw talent, providing deep support to help founders transition from an idea to a fully operational company. They held their first session during February.

Ornikar hits €100M in revenue 🚗

The driving school turned mobility platform Ornikar has surpassed the €100M revenue mark, continuing its expansion beyond driving lessons. With a diversified business model, the startup is cementing its position as a key player in automotive services and insurance.

Brevo to invest €50M in AI over five years 💰🤖

The email marketing giant Brevo is making a bold bet on AI, announcing a €50M investment plan to enhance personalization and automation. The goal? To integrate generative AI into CRM and marketing tools, competing with the likes of HubSpot and Salesforce.

Hero raises €50M to boost European SMEs 💸

Hero, a startup offering financing solutions for SMEs, secures a €50M funding round to expand cash flow support for small businesses. By integrating flexible credit options, the company aims to ease liquidity pressures for startups and SMEs struggling with delayed payments and financing gaps.

New Investment Director at Motier: Clément Lamolinerie 🔎

Mistral News:

Veolia x Mistral AI: Veolia partners with Mistral AI to turn its industrial sites into smart, AI-powered hubs, optimizing operations and sustainability.

Mistral AI launches mobile assistant: The French AI giant unveils a sleek mobile app for its AI assistant, bringing on-the-go smart conversations to users.

Mistral AI joins Helsing for European defense AI: A major move into defense tech, Mistral AI partners with Helsing to develop AI for European military applications.

Mistral AI builds its first data center in France: CEO Arthur Mensch announces Mistral AI’s first-ever data center, reinforcing France’s AI sovereignty.

Bankruptcy

Pepette: Fresh pet food startup placed under safeguard proceedings after struggling with financial losses despite a €5.7M Series A in 2022. The pet food market in France remains niche, unlike the booming U.S. sector.

Fruitz: Bumble shuts down the French dating app, just three years after acquiring it for $75.4M, citing a refocus on core business as its growth stagnated post-acquisition.

Call a Lawyer: Legaltech placed under judicial recovery, with Avoloi offering to acquire it for just €10K, planning to revive the brand but without retaining any employees.

Ynsect: The insect-protein giant files for judicial recovery, failing to secure a financial rescue despite €600M raised. With only weeks of cash left, it’s now urgently seeking a buyer to avoid collapse.

March Events 🛜

March 5

Pitch in Motion: An informal gathering in Paris where tech entrepreneurs and venture capitalists combine casual running with pitch sessions, fostering networking in a relaxed environment.

March 7

TECH TALK SHEEOS: In celebration of International Women's Rights Day, SheEOs and the Mairie of the 16th arrondissement of Paris are hosting a panel discussion featuring female tech entrepreneurs sharing their visions for the future, followed by a networking cocktail.

March 10-14

March 11-13

March 12

Deeptech Founders & VCs Meet (Hello Tomorrow Side Event): An exclusive side event during Hello Tomorrow's Investor Day, bringing together deeptech founders and venture capitalists from France, the DACH region, and the Nordics for networking and discussions on breakthrough innovations.

Healthcare x AI w/Galion Exe, Theremia & Sanofi: A fireside chat in Paris exploring the intersection of healthcare and artificial intelligence, featuring leaders from Theremia, Sanofi, and Galion.exe, organized by Utopia and Unaite.

March 13

March 14

The New Nordics Edge: A panel discussion at The Centquatre-Paris examining how the New Nordics are shaping Europe's future through investment and tech trends, with insights from Vinnova, VTT, and Bpifrance.

March 19

Meetup GAIN #8: The eighth meetup of the GenAI Network in Paris, focusing on implementing AI agents, discussing agentic workflows, tools, and real-world use cases in production environments.

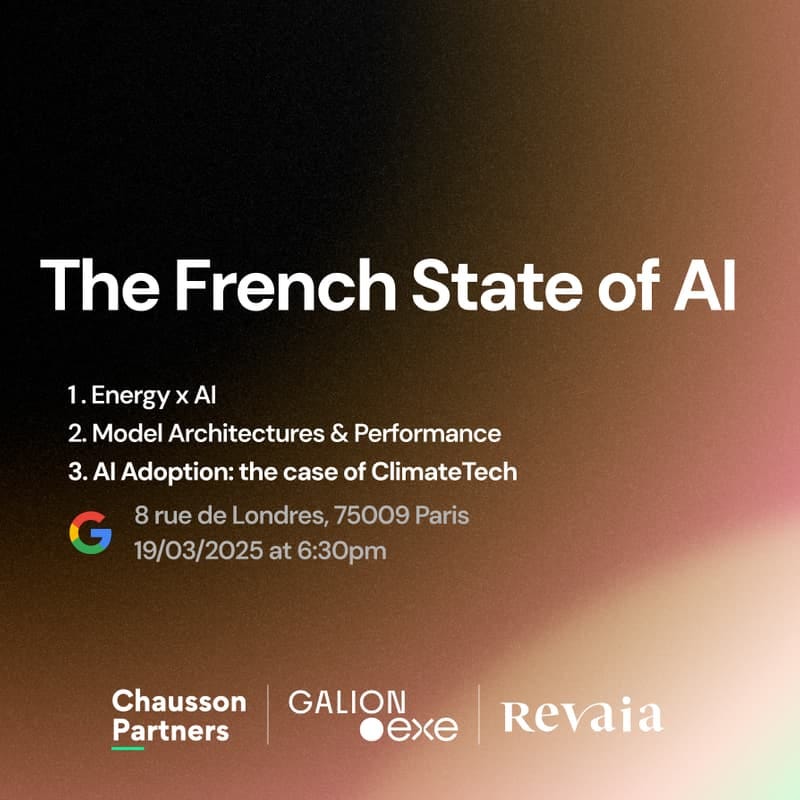

The French State of AI: An exclusive event at Google Paris marking the launch of The French AI Report 2024, featuring panel discussions on AI's role in energy and climate, model performance challenges, and networking opportunities.

During the month

Événements @ Climate House: A series of events at Climate House in Paris, focusing on six themes and twelve formats, aimed at educating, networking, and collaborative action on climate-related topics.

Conclusion

If you made it this far—well done. That was February in the French startup scene: big investments, bold AI bets, new funds, rebrands, acquisitions, and the rise of investment communities. March is shaping up to be just as intense. More deals, more shifts, more events. Let’s keep tracking what’s shaping the ecosystem. See you next month. 🚀